the federal government close It reached its 24th day, making it the second-longest shutdown in U.S. history.

Passing the three-week mark means federal employees miss your first full paycheck on Friday, leaving some wondering how to make ends meet until federal agencies are funded once again.

On Thursday, the Senate failed to advance legislation by Democratic Sens. Chris Van Hollen of Maryland and Sen. Gary Peters of Michigan and Republican Sen. Ron Johnson of Wisconsin who would have paid some federal workers during the shutdown.

He “Closing Fairness Act“, proposed by Johnson, failed by 55 votes in favor and 45 against, below the necessary threshold of 60 votes.

The Capitol is seen at dusk on the 22nd day of the government shutdown in Washington, October 22, 2025.

J. Scott Applewhite/AP

Meanwhile, Johnson opposed unanimous consent requests from both Van Hollen and Peters to advance his legislation.

Read on for a complete guide to all the assistance available to furloughed federal workers.

What does it mean to be on leave?

When an employee of a government agency is furloughed during a shutdown, it generally means that the agency employing the worker has experienced a shortfall in allocations and no longer has the funds necessary to operate, according to the US Office of Personnel Management. Due to a lack of appropriate funding, all non-essential activities are suspended during this time and some employees are placed on “non-work, non-paid” leave status.

“Exempt” employees, or those deemed “essential,” are expected to continue working during the shutdown without pay, according to OPM.

“Once the lapse in assignments ends, employees who were required to perform excepted work during the lapse will receive retroactive pay for those work periods,” the agency states.

Approximately 750,000 federal employees have been laid off during the current government shutdown.

Will laid-off workers receive back pay?

Generally, all employees furloughed during a government shutdown are paid at the end of the shutdown. in a letter from last month In detailing the possible effects of a shutdown, the Congressional Budget Office estimated that back pay for all federal workers could total about $400 million for each day of the shutdown.

Earlier this month, President Donald Trump indicated the possibility that the federal government could deny back wages to some employees suspended amidst the close.

When asked earlier this month whether government workers would receive back pay, Trump said journalists: “It depends who we’re talking about.”

“There are some people who don’t deserve to be taken care of, and we will take care of them in a different way,” Trump added.

Within hours, members of Congress from both major parties saying They supported back pay for laid-off workers.

What types of leave assistance programs exist for affected federal employees?

Yes, states that have a significant population of federal employees, such as Maryland, Virginia, and New York, have established assistance programs to help federal employees pay for things like housing and food.

At the beginning of the shutdown, Maryland Governor Wes Moore announced a series of housing protections available to furloughed federal employees including mortgage support, energy assistance, eviction resources and more.

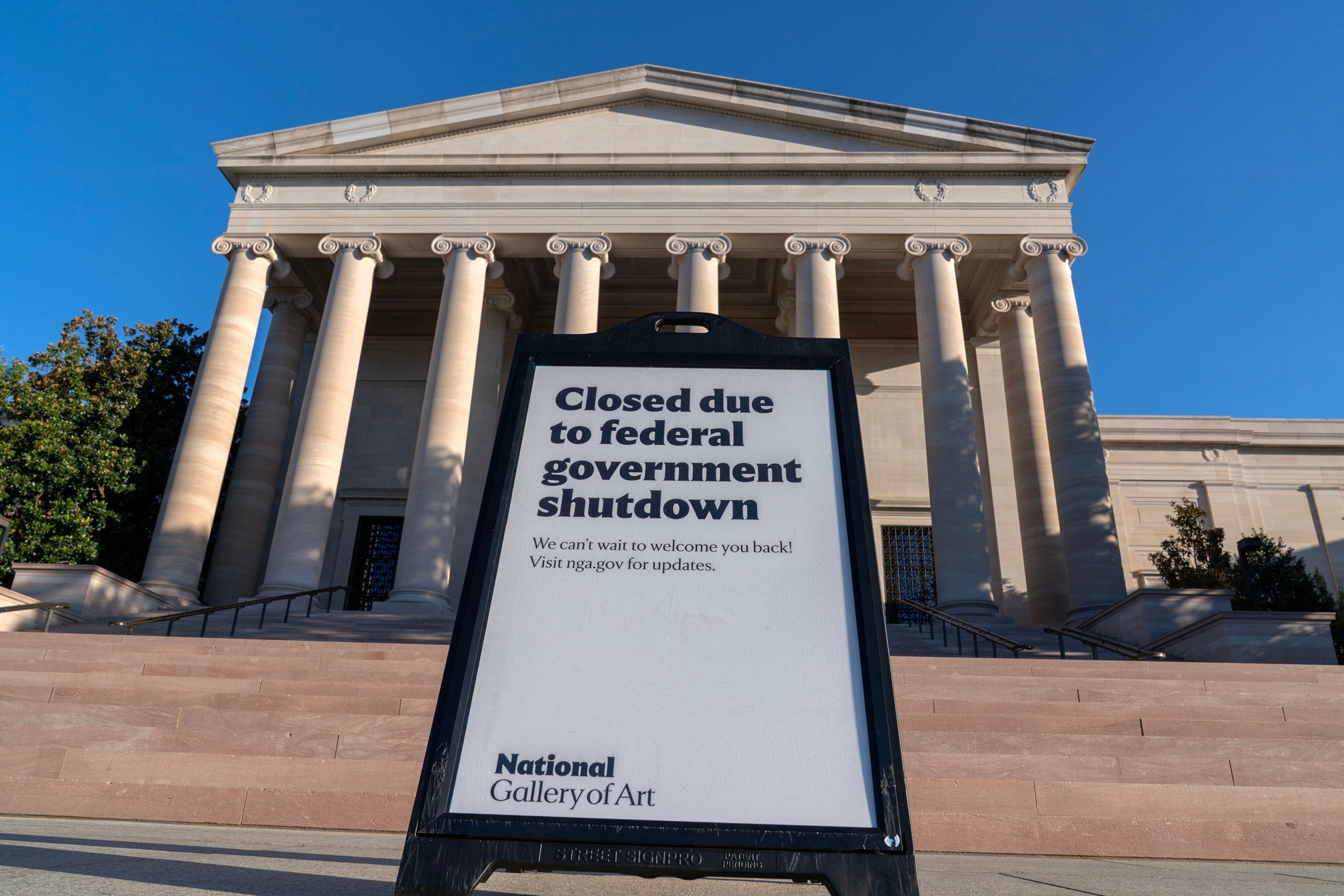

A sign reading “Closed due to federal government shutdown” is seen outside the National Gallery of Art in Washington, Oct. 6, 2025.

Jose Luis Magana/AP

Arlington County, Virginia, is located just across the Potomac River from Washington, D.C., and is home to about 25,000 federal employees, according to the county report. website — is offering furloughed workers a number of critical resources, including job placement services, health care and food assistance, housing resources and even assistance for their pets.

The county has warned landlords against eviction during the shutdown, stating on its federal employee assistance website that “landlords and rental property owners [should] Exercise flexibility so as not to displace or negatively impact households during this difficult period.”

Other states across the country are offering unemployment insurance programs that may be helpful in keeping furloughed workers afloat until the shutdown ends.

Suspended workers can consult the CareerOneStop Websitesponsored by the U.S. Department of Labor’s Employment and Training Administration, to better understand your unemployment funding opportunities amid the shutdown.

Other groups are also working to help furloughed federal employees.

Feeding America, a nonprofit network of 200 food banks across the country, has pledged to feed workers affected by the shutdown but warned of the strain this will put on food banks.

“A prolonged closure will deepen tension and more families will seek help at a time when food banks are already stretched to the limit due to sustained high need,” the organization said. he wrote on his website.

My federal benefitswhich is not sponsored by the federal government or any of its agencies, has compiled a map listing restaurants in several American cities that support federal workers with food.

The AFL-CIO, the nation’s largest federation of unions, has compiled a comprehensive list of benefits for federal workers, state by state. here.

Are there any furlough assistance loans available for affected federal employees?

Several financial institutions across the country are offering furlough assistance loans specifically designed to help federal workers affected by the current government shutdown.

Navy Federal Credit Union has established a loan program that offers a 0% APR loan during the shutdown for members who are federal workers affected by the shutdown.

USAA also offers a 0% APR loan program up to your salary amount of $500 to $6,000. Eligibility criteria include having a USAA account and a direct deposited government paycheck.

those with a Savings Savings Plan (a retirement plan for federal employees and members of the uniformed services) who have borrowed money from their account in the form of a TSP loan will remain current, even without payments, throughout the shutdown, according to the Federal Retirement Savings Investment Board, the independent agency that administers the program.

“If you have a TSP loan and are an active participant (not separated from federal service or otherwise in default status), we will automatically update your status to keep your loan current, even if we do not receive refunds during the closure,” the TSP website states.

Suspended employees should be vigilant when requesting assistance to avoid becoming victims of scams or fraud. The Federal Deposit Insurance Corporation, or FDIC, and the Federal Trade Commission’s Bureau of Consumer Protection offer tips to protect yourself here and here.

ABC News’ Allison Pecorin contributed to this story.